Multiplying one’s wealth through investing in gold-made items has been known since the dawn of modern history. Gold bars, medals, antique jewelry, and pieces from the most famous jewelers – the king of precious metals offers a wide range of products, but gold coins, among which we distinguish bullion coins and historical coins, are the most frequently chosen products among collectors and investors, with demand for them increasing every year. Why are they so popular and what are the benefits of investing in historical coins?

HISTORICAL COINS

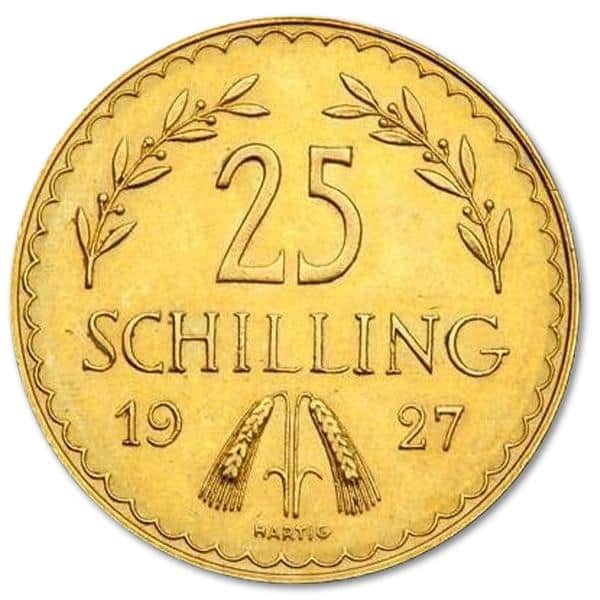

Searching for information on what historical coins are, we come across definitions that characterize them as rare securities, produced before World War II, whose market value significantly exceeds the value of the metal contained in them, such as gold, silver, copper, bronze, or nickel.

WHAT AFFECTS THE HIGH PRICES OF HISTORICAL COINS?

It depends on several factors – limited availability, quality (condition), sentimental value (associated, for example, with a specific design), and market demand. One of the most expensive rare coins sold at auction is the silver-copper American dollar, called the “Flowing Hair Dollar”, which a collector from Las Vegas acquired for 10 million dollars in 2013. Flowing Hair is a special numismatic item – it is one of the few well-preserved specimens from the first series of coins issued by the US federal government in 1794. Legend has it that the coin was found in an old chest of drawers.

Since the minting of these coins is long past, they are now mostly sold and traded by precious metal dealers through gold and silver buybacks and numismatic shops.

Here are the five most important reasons why historical coins are popular among collectors and why it is worth investing in them:

1.Provide portfolio diversification.

When it comes to investing, portfolio diversification is the so-called golden rule. Allocating capital to various asset classes, through securities, real estate, investment funds, paintings, and historical coins, allows you to diversify your investment portfolio and thereby minimize the overall risk of losses and provide protection against inflation. It is also worth remembering that, unlike precious metal markets, historical coins do not tend to have price fluctuations – they are somewhat isolated from unforeseen price changes and destabilizing market forces. Why? Because they have a huge collector base. It is estimated that in North America alone, the number of collectors is over 140 million! For comparison, in Poland, this number ranges between 10-20 thousand, although other sources mention 30-40 thousand, but it is difficult to obtain specific data as the number increases every year.

2.They are liquid assets.

Asset liquidity is another important aspect of an investment strategy. Historical coins (especially gold ones) are globally liquid assets that can be easily converted into cash at any time and place – active coin buyback and sales markets exist worldwide.

3.You can own a piece of history and art.

Historical coins are not only an investment but also works of art with a rich history, extraordinary testimonies of culture and social transformations that connect us to our heritage more strongly than other assets.

4.Collecting historical coins has educational value.

Collecting numismatics was once called the “hobby of kings” and is undoubtedly one of the oldest hobbies in the world – the first documented traces of collecting securities can be found in the chronicles from the times of Octavian Augustus, who describes Caesar’s fondness for collecting old Roman coins, as well as those found in the territories conquered by Rome. Collecting offers a deeper understanding of the historical and cultural period from which a particular coin originates; it is an activity that you can share with your partner, friends, children, or grandchildren.

And finally…

And finally…

Thoroughly research the market before investing.

If you are thinking of investing in collectible, historical coins, we have one piece of advice for you: thoroughly research the market. Read articles from qualified websites, browse posts on numismatic forums. This will help you identify high-quality coins at a fair market value and make calculated decisions. Also, remember to buy from respected, trusted dealers and collectors, which will protect you from investing money in counterfeit items.

Comments are closed.